There is little, if any, possibility of compromise on one side or the other of the gun debate, and so the vast majority of minds have already been made up as to where they stand on the polarizing issue.

As to how that affects companies selling guns and/or ammunition, it actually makes it fairly easy to know the market and resultant supply and demand equation associated with it.

Having said that, the raw emotion that comes with the territory requires those investing in gun or ammo companies to wade through the clutter and look closely at the data. As a matter of fact, if investors were to approach all companies they invest in in the way gun companies must be approached, they would be much more successful in their choices. By that I mean removing the hype accompanying most firms and look at it as objectively as humanly possible.

In reference to guns, that must be done by not accepting data that is revealed in half-truths and omissions. For example, the number usually thrown out for annual deaths by guns in the United States is about 30,000. The insinuation is there are 30,000 homicides in the U.S. every year. That's not true at all. About two-thirds of those deaths are suicides, so you have to immediately shave off about 20,000 deaths to get an accurate picture.

If people reach the place of taking their own lives - unless there's intervention of some sort - they'll find a way to do it. It's not like it's something new in the world because of there being guns available.

Prescription Drugs and Gun Deaths

Prescription drugs are coming under increasing scrutiny, not only for their role in many multiple homicides, but even more so for the cause of deaths from those ingesting the legal drugs.

The number of annual suicide deaths from prescription drugs are about 16,000 a year, with deaths from all prescription drug use over 100,000 annually. There is no doubt there are far more suicides from drug use, but only those with evidence of "force against oneself" are identified as suicides. Substance abuse that is considered unintentional, which are by far the majority of prescription drug deaths, aren't included in suicide statistics, even though the drugs are known to have been radically abused by the one taking them.

With women 50 and older alone, from 2005 to 2009 the number of suicide attempts using prescription drugs rose from 11,235 to 16,757. Women are more likely to take their lives using prescription drugs than men.

All of this is said to note that annual prescription drug deaths - whether accidental or intentional - are about ten times more than homicides using firearms.

As a matter of fact, many multiple homicides have included the perpetrators being under the influence of prescription drugs; a fact that is underreported by mainstream media outlets and protected by the industry. A number of other multiple homicides using guns are suspected to have had the murderer being under the influence of prescription drugs, but officials haven't denied or confirmed that either way.

Gun Crimes Plunging

According to Bureau of Justice Statistics, the number of homicides involving firearms has plummeted from 1993 to 2011. Here are some of the highlights of the study:

Firearm-related homicides declined 39%, from 18,253 in 1993 to 11,101 in 2011.

Nonfatal firearm crimes declined 69%, from 1.5 million victimizations in 1993 to 467,300 victimizations in 2011.

Firearm violence accounted for about 70% of all homicides and less than 10% of all nonfatal violent crime from 1993 to 2011.

From 1993 to 2011, about 70% to 80% of firearm homicides and 90% of nonfatal firearm victimizations were committed with a handgun.

Source of Guns

Another set of facts, according to a DOJ survey, is the vast majority of criminals using guns in homicides and other crimes didn't get their firearms through so-called gun show "loopholes."

The most recent statistics available from the DOJ - whereby they surveyed prison inmates in 2004 - found that 40 percent of inmates got their guns illegally; 37 percent said they obtained their guns from family or friends; and 10 percent acquired them from a pawnshop or retail outlet. How many obtained their guns from a gun show or at a flea market? A miniscule 2 percent. Those are the facts.

All of this is mentioned in order to separate the wheat from the chaff when analyzing the gun and ammunition industry.

Media and the Gun Control Battle

The opposing forces in the gun battle are using the media to rally the troops and influence public opinion.

Gun control advocates use the child-victim theme as their main lever, while 2nd Amendment supporters go the route of the results of past historical gun grabs, which were followed by mass exterminations.

There are other ways they battle it out, but these are the go-to themes when needing to get emotions stirred up by the respective base of each side. Below are images representing both points of view. As you can see, there isn't much in the way of common ground to work with either side, as they view it as life or death from different perspectives.

Media and politics - whether accurate or not - do play a big part in the firearms debate, and so must be included in deciding on whether or not to invest in the sector.

Nonetheless, that's related to how those watching the debate are being socialized into accepting the proposed narrative of each side. Over time what really matters is whether or not it's having an effect on the sales of guns and ammunition. In that regard the gun and ammunition manufacturers are winning hands down, as are the retailers selling them.

Pensions Divesting of Gun-Related Stocks: Does it Matter?

Another skirmish in the overall gun battle is the announcements by pension funds located in ultra-liberal states that they're divesting of stocks they've held that manufacture guns or ammunition.

The latest pension fund to make that decision is the New York City Employees' Retirement System, which announced it is divesting its holdings in the industry. Odd that they did that after a big jump in share price over the last year or so. In January CalSTRS, the California State Teachers' Retirement System, took similar steps.

These are pretty much completely irrelevant to the gun industry, as the majority of people in these two states already have made their minds up on the issue. As for the influence factor beyond the borders of the states, there could be some value there, but there aren't that many undecided people at this time, so it's very minimal as to its effects, other than making a statement to those already convinced. It's also likely that behind the scenes, gun control advocates pressured the pension funds to take these steps.

Gun and Ammo Supply and Demand

Taking in the overall scenario, the outcome has been a huge and growing demand for firearms and ammunition, which has not only driven up the price, but also resulted in shortages, especially with ammo.

There are questions surrounding the Department of Homeland Security bidding on 1.2 billion rounds of ammunition, which has created a shortage while driving up prices. If the purpose was to slow down sales by creating an artificial shortage of ammunition, it has backfired, as gun enthusiasts continue to line up on days retailers receive ammo in order to get their desired ammunition. Some also buy up some ammo whether they need it or not, presumably to resell to friends or possibly trading purposes. Whatever the reason, manufacturers can't keep up with the soaring demand for ammunition.

Included in the ongoing battle for background checks and widening registration requirements is fear, which is driving gun owners to stock up. While it has resulted in those who never owned guns to buy them and the ammunition associated with them, this trend is being driven primarily by existing gun owners by far.

With Obama in office, it can be counted on that this won't change any time soon. This makes the next three years or so one of the more predictable corporate trends that can be counted on.

The downside risk would be if the politics of the issue changed and major new laws were implemented. Yet in the short term, that would be a positive for the industry, as it would generate even more sales.

For the firearms and ammunition industry, there is nothing to suggest a slowdown in demand anytime in the near future.

Investment Implications

What's very informative about the gun and ammo sector is it appears companies that provide the ammunition believe the huge demand for the product is going to be a temporary one. That conclusion is reached because the manufacturers aren't adding capacity.

By not adding capacity I'm referring to building larger facilities to meet the surging demand. Some companies have added hundreds of employees to the workforce, as well as boosting overtime. In some cases they're running the factories day and night. Even so, they aren't looking at increasing the physical operations at this time. That could be a mistake in the years ahead if the political climate and opposing forces continue to battle it out while checkmating one another.

As for the manufacturers, the public companies I've analyzed appear to be those experiencing the most pressure. The retailers, while getting some flack from those opposing the 2nd Amendment, aren't the main focus of opponents of the right to bear arms.

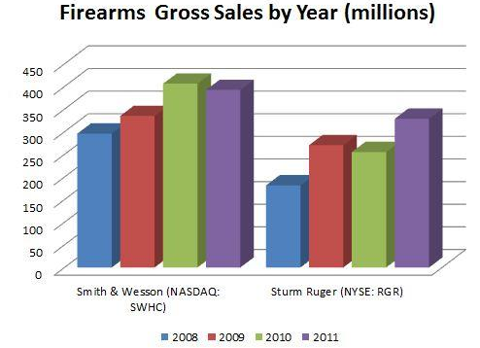

That means Sturm Ruger (RGR) and Smith & Wesson (SWHC) - as far as publicly traded companies go - are those facing more scrutiny and pressure. There are far more private gun manufacturers than these two - which is important from a competitive point of view - but as for media focus, they aren't as important in the public opinion wars at the national level, although locally they may get more heat.

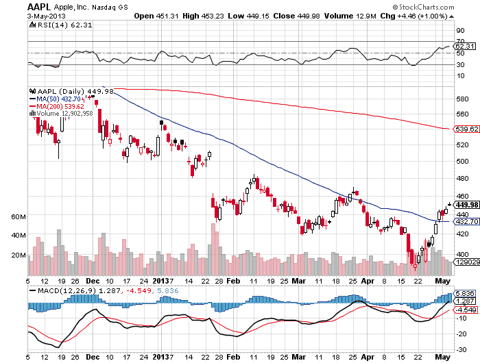

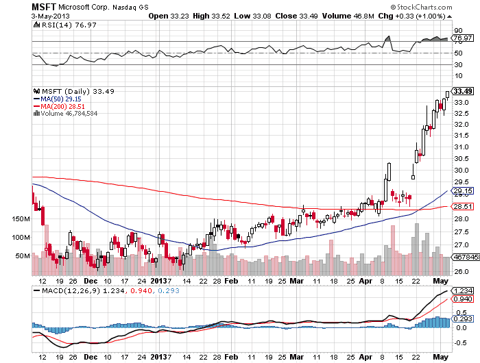

As you can see in the two charts below, Sturm Ruger and Smith & Wesson - because of the exposure to news cycles - have been very volatile over the last year, although they have gradually moved up even after big spikes and declines on some trading days. That will be the way the share prices of the two companies perform going forward as well. Thus it's imperative to get in on the dips, as it could take some time to recover if you invest after big upward moves. You can see that with December sales for Sturm Ruger, and for seasonal sales from October through December with Smith & Wesson. Buying before people start thinking in terms of Christmas is important with these two stocks. Newtown of course was a part of the uptick in December sales.

Sturm Ruger

Smith & Wesson

(click to enlarge)

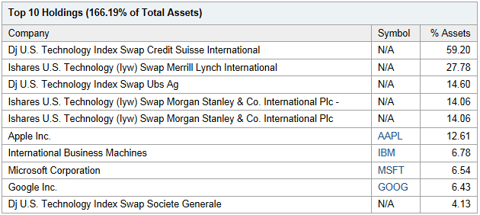

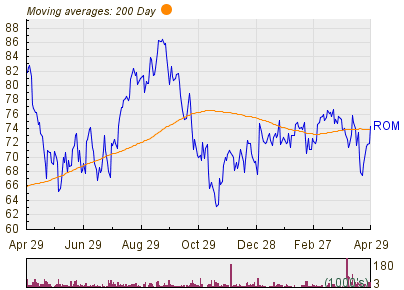

Alliant Techsystems (ATK) serves the aerospace/defense industry, which a significant part of that being the production of ammunition for the hunting and sports market. That includes ancillary goods such as gun care products, scopes, targets, and reloading equipment, among other related items.

ATK recently announced it is going to acquire Caliber Co., the parent company of Savage Sports. The price of $315 million represents a 5.5 multiple of its trailing-12-month EBITDA. Savage is one of the leading manufacturers of shotguns and hunting rifles, and fits in well with the overall product mix of Alliant. Adding a gun manufacturer to the ammunition line is a good move.

The company said it thinks Savage will be accretive to its current fiscal year earnings per share. Financing of the deal came from existing cash and its current credit facility. As you can see below, this should boost an already highly successful company.

Alliant Techsystems

(click to enlarge)

Another good option is Olin Corporation (OLN), which generates about 37 percent of its revenue from gun and ammunition sales. The other revenue comes from chlorine and alkaline products.

Another good option is Olin Corporation (OLN), which generates about 37 percent of its revenue from gun and ammunition sales. The other revenue comes from chlorine and alkaline products.

Over the last year, Olin has performed very well, with its Winchester unit helping boost the company.

Still, one has to view Olin differently than the rest of the players in this sector, as its totally different chemical units make it unique. Since 63 percent of revenue comes from chemicals, it must be primarily considered a investment in that sector rather than in firearms, although ongoing demand could easily boost revenue from the Winchester unit.

Consequently, this is a more predictable play than the pure gun and ammunition manufacturers over the last year.

Olin

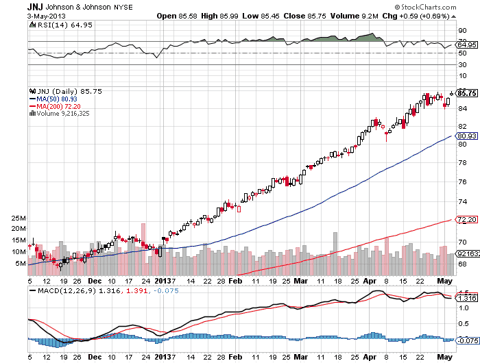

Another awesome stock to consider is Cabela's (CAB), which may be one of the best in this grouping here. The outdoors company has more than doubled its share price over the last year, and appears to have a lot of room to grow.

Gun and ammunition sales have helped them outperform, but what makes them even more compelling is when you strip out gun and ammunition sales, the company's same store sales still climbed by 9 percent, with 10 out of 13 merchandise subcategories increasing. This has partly to do with the perception the economy has been improving.

Along with impressive revenue growth is just as impressive earnings growth. Net income has also been solid. Cash flow from operations has also been up. One area of risk is its debt load, but the rest of the positives will overcome that if the solid performance of the company continues on.

The company said in its recent conference call that it's keeping exterior guidance in place, suggesting they may still have some significant upside potential, which will give the share price of the stock a big boost if it outperforms.

Cabela's

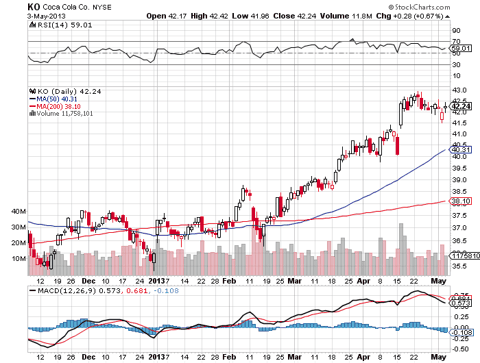

Finally, Wal-Mart (WMT), which is the biggest player in many sectors, is also one of the largest sellers of firearms and ammunition in the world. Obviously it'll be less affected by direct sales because of its enormous size, but the key factor there is the market it serves, which for the most part in America, is located in gun-supporting regions of the country.

That means potential for ancillary sales when people come in looking for ammunition and guns. The jump in sales and good will from its customer base is reflected in the nice move up in share price from a year ago.

Wal-Mart

Risks

With such a positive environment for gun and ammunition sales, is there any risk in the near or medium term for companies selling guns and ammunition? The answer is yes, but not for the reasons I've been reading some writers assert.

According to them, it's the implementation of gun control measures which would snuff out the growth. Not only is that the furthest from the truth, it's the exact opposite.

What would stop this extraordinary growth? It would be to stop the aggressive attempt to restrict guns and gun ownership. As long as the public perceives an attack on the right to bear arms, they're going to continue to stock up on guns and ammo. If politicians would stop their attempts to regulate guns, most of the fears would subside and demand would be cut back.

The reason I say gun control laws wouldn't stop growth is people would continue to buy firearms and ammo whether laws are put in place or not. It would just be done from different outlets than they are buying from now. This could be a risk to gun retailers, but not to gun manufacturers.

In my view risk would be to lower the hype and rhetoric from some government mouthpieces and entities, which would cause gun owners to relax and ease up on buying guns and ammunition.

Since that's highly unlikely, as well as it being unlikely any significant legislation that would be a game changer being implemented, it looks like companies with strong exposure to guns and ammunition will continue to do well.

Higher prices aren't a risk, as they have continued to climb without making a dent in the rising demand. Other than food and water, gun enthusiasts consider firearms and ammunition as one of the most necessary items to own. That isn't going to change.

Competition

As mentioned earlier, a lot of the competition in the sector is from private companies, which are numerous around the country.

In the current atmosphere, that has had absolutely zero effect on demand and sales. Demand is so overwhelming that everyone, especially in the ammo field, have enormous supply challenges. This won't change any time soon.

There is no advantage here for the majority of companies, as whoever can provide the ammo and desired firearms will be the companies which get the sales. To a lesser extent this is true with some firearms, with brands playing a bigger role there.

Conclusion

While concerns over potential gun legislation has driven gun and ammunition demand, a secondary factor has been concerns over the economy and the resultant crime that always grows in response to economic weakness. That is going to remain the trend in the near future.

The main demand drive will remain gun control efforts though, and as long as the aggressive positioning and push continues on from politicians, and is reinforced by mainstream media outlets, there is no way the demand for guns and ammunitions is going to subside. After all, what would be the catalyst if things continue on as they now are?

Even after gun control efforts are swept aside by lawmakers, gun control advocates assert they'll never give up. While that may be true politically, it plays into the gun and ammunition demand scenario.

It's apparent there will be no disruptive gun control legislation in the near future, and those companies with exposure to guns and ammunition will continue to benefit from that reality.